Are you a passionate technologist looking to break into the world of high-performance trading? Join a cutting-edge proprietary trading firm as a C++ Software Engineer, where you’ll play a key role in building and optimizing one of the fastest, most sophisticated trading platforms in the industry.

This is a rare opportunity for driven, early-career engineers to work alongside world-class quants and technologists, fine-tuning systems that operate at the bleeding edge of low-latency trading. If you thrive on technical challenges, love pushing systems to their limits, and want to make an immediate impact, this role is for you.

What You’ll Do:

– Design, build, and optimize high-performance trading infrastructure in C++ on Linux.

– Work across the full stack of a real-time trading system—from network optimizations to core strategy execution.

– Collaborate with quants and traders to solve complex problems at the intersection of math, finance, and systems programming.

– Continuously improve latency, reliability, and scalability in a competitive, fast-paced environment.

What We’re Looking For:

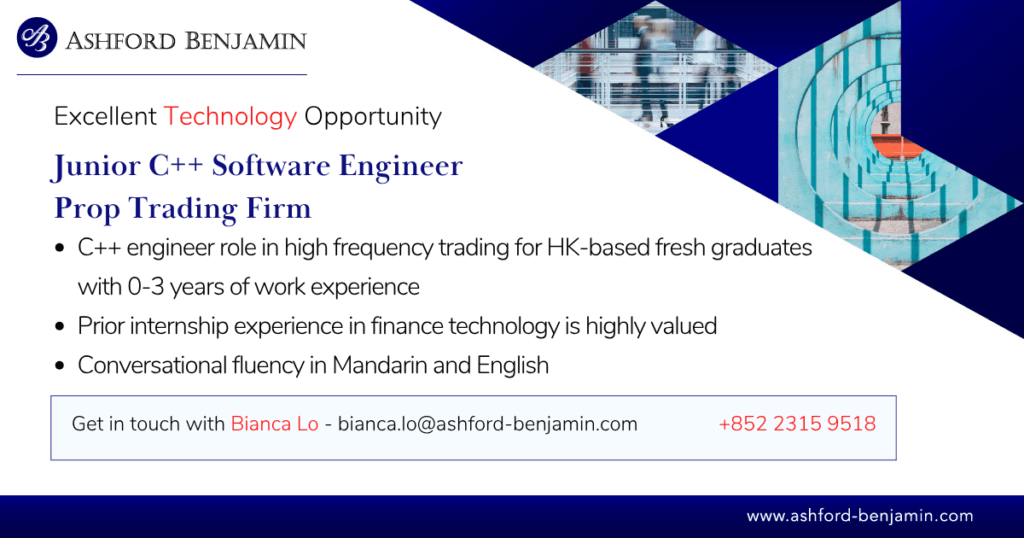

– Recent graduate (BS/MS) in Computer Science, Engineering, Math, or related field—or up to 3 years of full-time work experience.

– Strong C/C++ skills (academic, internship, or project experience is great!), ideally working on performance problems

– Familiarity with Python and Linux/UNIX environments.

– A problem-solving mindset, with interest in low-latency systems, algorithms, or quantitative finance.

– Team player who enjoys collaborating, learning, and sharing ideas.

– English and Mandarin speakers

Bonus Points For:

– Knowledge of math, statistics, or algorithmic optimization.

– Exposure to trading, real-time systems, networking, or cloud infrastructure.

Why Join?

– Learn from the best—mentorship from senior engineers, traders and quants with top-tier finance backgrounds.

– Fast-paced, innovative culture—small team, flat hierarchy, and no bureaucracy.

– Go deep into prop trading and high frequency trading— work on technically challenging problems, and make an impact from day one on trading performance

– Small team— you can ask questions, get exposure to people working in all types of functions at a trading firm to better understand what path you want to go down in Finance Technology

If you’re a curious, competitive, and hands-on engineer eager to dive into high-frequency trading, my client would love to hear from you.

Please email Bianca.Lo@ashford-benjamin.com – I am a Finance Technology headhunter working with clients across buy-side, sell-side and crypto industries in APAC.

To apply for this job email your details to bianca.lo@ashford-benjamin.com